Expert Tax Attorneys, Immediate Results

Or book your Appointment Below

We Earn Your Trust And Work Diligently On Your Case

$435 M

Recovered So Far

100%

Reduction in your time

8,700+

Cases Solved

Popular Services

No matter how big or small your tax matter, We have the knowledge and experience to handle your legal needs and to represent you!

Unfiled Tax Returns

Unpaid payroll taxes can result in fines and even business asset seizures. An assigned tax attorney, will perform a comprehensive review of your case.

Tax Relief

During your initial FREE consultation, our tax consultants complete a detailed financial interview with you to determine if an OIC can be pursued.

Wage Garnishment

With unfiled tax returns or an outstanding balance owed to the IRS, you are in danger of a wage garnishment.

Payroll Tax Negotiation

Need help negotiating payroll taxes and reducing taxes? Our tax attorneys are here to negotiate for you.

IRS Audit Defense

When the IRS comes knocking, we will answer the door and make sure our expert tax lawyers defend your case.

Resolve Back Taxes

Unresolved back taxes? We can resolve them for you before they get out of hand. Let our tax resolution experts handle it for you.

Defining success together

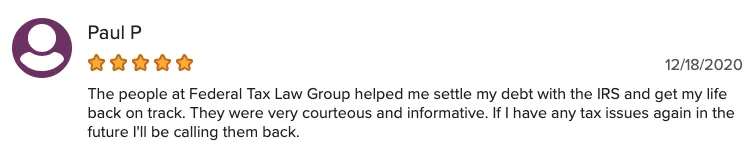

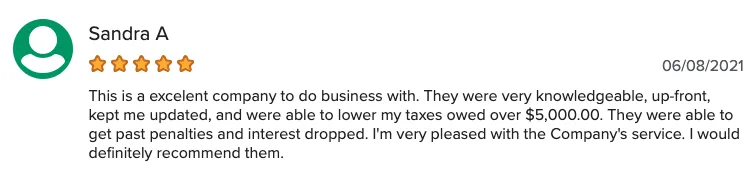

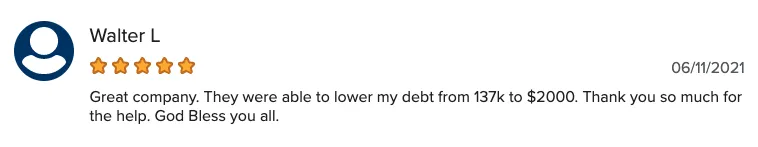

Hear From Our Clients

Defining success together

We Earn Your Trust And Work Diligently On Your Case

In most companies, your tax professionals are assigned by default. At Federal Tax Law Group, your case is assigned based off the facts of your case and then paired with the professional with the optimal knowledge and expertise so that you get the very best person for the job.

To help us achieve the best results every time, we've assembled a support team of attorneys, enrolled agents and tax preparers to ensure your case is moving along towards the final desired result as quickly as possible.

Experience You Need, Results You Want

Step 1

Consultation

100% Free

Step 2

Investigation

Initiate Client Protection

Establish Communication

with IRS

Step 3

Best Resolution

Establish IRS Compliance

Achieve Best Resolution

Step 4

Freedom

Case Closed

“The tax resolution companies reference herein are not law firms nor are such representations being made. While they may employ attorneys, CPA’s and enrolled agents pursuant to IRS Regulation Circular 230, the use of the term ‘Tax Attorney’ is used as a general or generic term referencing attorneys seasoned in aspects of tax relief and collection work. They may or may not have a specialized degree in taxation or be individually licensed in your particular state.”

“The tax resolution companies reference herein are not law firms nor are such representations being made. While they may employ attorneys, CPA’s and enrolled agents pursuant to IRS Regulation Circular 230, the use of the term ‘Tax Attorney’ is used as a general or generic term referencing attorneys seasoned in aspects of tax relief and collection work. They may or may not have a specialized degree in taxation or be individually licensed in your particular state.”